zero beta portfolio|beta neutral portfolio : Tuguegarao What Does Zero-Beta Portfolio Mean? Investors with a very low-risk tolerance need to minimize investment risks as much as possible. The Zero-Beta Portfolio is created in . Winning at slot machines isn’t something you can really have a strategy for, in the same way that you would with other casino games. That’s because slots are 100% luck-based, with those massive, life-changing payouts coming on some truly random wins. But, if that makes you feel like there’s nothing for you to do, then all is not lost.

PH0 · find beta of portfolio

PH1 · beta of zero means

PH2 · beta neutral portfolio

PH3 · Iba pa

Here at Pickswise, our expert NBA handicappers follow all of the latest NBA news and trends as well as the key player and team stats to bring you the best NBA betting advice on every match of the NBA Season. We also provide our Experts’ Basketball Picks and NBA Predictions, . How To Bet on MLB.

zero beta portfolio*******What Is Zero-Beta Portfolio? A zero-beta portfolio, also known as a market-neutral portfolio, is a investment strategy designed to eliminate systematic risk by maintaining a beta of zero. Beta . A zero beta portfolio is constructed by carefully selecting assets that have a beta of zero. These assets are typically those that are not influenced by the broader .

To forge a zero-beta portfolio, one combines positively beta-ed assets with those of negative or low beta values, a strategy akin to delta-neutral option strategies. The aim is . A zero-beta portfolio is a portfolio built with zero systematic risk. How Does a Zero Beta Portfolio Work? The investments comprised in a zero-beta portfolio .

What Does Zero-Beta Portfolio Mean? Investors with a very low-risk tolerance need to minimize investment risks as much as possible. The Zero-Beta Portfolio is created in . What is a Zero-Beta Portfolio? A zero-beta portfolio, as the name suggests, is a portfolio that has a beta value of zero. Beta measures the sensitivity of a stock or a .

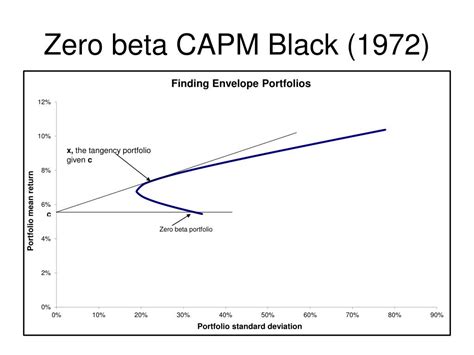

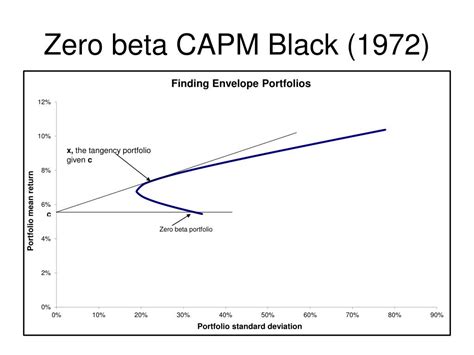

A Zero-Beta Portfolio is a portfolio with no market risk or beta of zero, meaning its returns are uncorrelated with the market. Learn how to construct a Zero-Beta Portfolio, its .zero beta portfolioZero-beta portfolio. A portfolio constructed to have zero systematic risk, that is, having a beta of zero. Zero beta portfolios: Zero beta portfolios are constructed by combining assets in a way that their beta coefficients cancel each other out, resulting in a portfolio . Zero beta portfolios are designed to have no correlation with the overall market, providing investors with a stable and predictable return. However, this stability comes at a cost, as there are several risks associated with investing in these portfolios. 1. Lack of Diversification: One of the major risks of zero beta portfolios is the lack of . A zero beta portfolio is designed to have no correlation with the overall market, making it an attractive option for investors seeking to hedge against market volatility. In this section, we will delve into the intricacies of a zero beta portfolio, examining its benefits and drawbacks from various perspectives. 1. Definition and Calculation of . Empirical tests of the market model found that the relationship between CAPM beta and U.S. stock returns was weaker than expected. Relaxing some of the assumptions of the CAPM, Black ( 1972) proposed the zero-beta CAPM. This more general form of the CAPM adds a new zero-beta portfolio factor that is uncorrelated with the . The zero-beta portfolio ended above TLT and slightly below SPY, but had much better risk-adjusted performance, as you can see below. Table 1. Performance metrics from July 30, 2002, to Nov. 3 .知乎专栏提供一个平台,让用户可以自由地进行写作和表达自己的观点。 A zero beta portfolio is a basket of investments that have zero correlation with the market. As beta indicates systematic risks, a zero-beta portfolio has nil systematic risks. Since there is no correlation to the market, it is more like a risk-free portfolio. Due to this, the rate of return on a zero-beta portfolio is low.

Um gerente de portfólio deseja construir um portfólio beta zero versus o índice S&P 500. O gerente tem $ 5 milhões para investir e está considerando as seguintes opções de investimento: Estoque 1: tem um beta de 0,95. Estoque 2: tem um beta de 0,55. Bond 1: tem um beta de 0,2. Bond 2: tem um beta de -0,5. Commodity 1: tem um beta . You obtain a coefficient b b. Then consider the new portfolio P′ P ′ defined as P′(t) = P(t) − bM(t) P ′ ( t) = P ( t) − b M ( t). P is then a zero-beta portfolio. However you must frequently compute the regression to adjust the coefficient b b. Improve this answer. How to build a 0- β β portfolio was addressed by the two other .beta neutral portfolio You obtain a coefficient b b. Then consider the new portfolio P′ P ′ defined as P′(t) = P(t) − bM(t) P ′ ( t) = P ( t) − b M ( t). P is then a zero-beta portfolio. However you must frequently compute the regression to adjust the coefficient b b. Improve this answer. How to build a 0- β β portfolio was addressed by the two other .zero beta portfolio beta neutral portfolio You obtain a coefficient b b. Then consider the new portfolio P′ P ′ defined as P′(t) = P(t) − bM(t) P ′ ( t) = P ( t) − b M ( t). P is then a zero-beta portfolio. However you must frequently compute the regression to adjust the coefficient b b. Improve this answer. How to build a 0- β β portfolio was addressed by the two other .

A new CAPM dubbed the ZCAPM was recently proposed by Kolari, Liu, and Huang (KLH) ().In their book, the authors derived the ZCAPM as a special case of the more general zero-beta CAPM of Black ().Footnote 1 The theoretical ZCAPM is comprised of only two factors: mean excess market returns and the cross-sectional standard deviation of returns for all .

Stock ABB’s beta of 1.2 X its fractional portfolio of 0.125 = 0.15. 4. Add up the individual weighted betas. Here is the whole hypothetical portfolio with a total beta of 1.22, benchmarked to the S&P 500. That means when the index moves 1%, this portfolio as a whole is 22% more risky than the index. Stock. Value. Get the Script: Patreon: https://www.patreon.com/quantitativeFinance Want to Connect?LinkedIn: https://www.linkedin.com/in/jason . Beta is a measure of the volatility , or systematic risk , of a security or a portfolio in comparison to the market as a whole. Beta is used in the capital asset pricing model (CAPM), which .Ein Betafaktor größer als 1,0 zeigt an, dass die Aktie oder das Portfolio voraussichtlich stärker schwanken wird als der Vergleichsindex. Ein .

Zero-Beta-Portfolios sind so konzipiert, dass sie keine Korrelation zum Gesamtmarkt aufweisen und Anlegern eine stabile und vorhersehbare Rendite bieten. Diese Stabilität hat jedoch ihren Preis, da mit der Investition in diese Portfolios mehrere Risiken verbunden sind. 1. Mangelnde Diversifizierung: Eines der größten Risiken von .1. I am trying to solve the zero portfolio problem in R. Given n assets, the objective function is to minimize the variance of the portfolio Minx 1 2xTΣx subject to COV(xTR, RTm) = 0 and xT1 = 1 and μTx ≥ τ Where x are portfolio weights, τ is a required return and Rm is a representative market index. I have seen the relevant discussion . Stockₐ weight = (Total number of Stockₐ / Total stock in the portfolio) x 100. Step 3. Find the weighted beta. Determining the weighted beta is where you will take the stock’s weighted percentage you found in step 2 and multiply it by the stock beta. Beta weight = Stockₐ weight (x) Stockₐ beta.

A zero-beta portfolio, as the name suggests, is a portfolio that has a beta value of zero. Beta measures the sensitivity of a stock or a portfolio’s returns in relation to the overall market. While a positive beta indicates that a stock or portfolio tends to move in the same direction as the market, a negative beta suggests an inverse .

Definition of Zero-Beta Portfolio. A zero-beta portfolio is a financial instrument that carries no systematic risk, making it an optimal solution for risk-averse investors. Its expected return equals the risk-free rate of return, which is typically quite low, and it has zero correlation with market movements, offering protection against market .

“Pero in fairness pre, maganda’t palung-palo pa rin ang katawan nung ate mong iyon. Napakaswerte talaga ng kuya Paul mo sa kanya” ang sabi ni Roel. “Aaminin ko sa iyo pre, minsan pinagpapantasyahan ko yang ate mo pag nagbabate ako sa banyo” pag-amin ng kanyang kaibigan. More hot Pinoy stories at pinoyeroticstories.wordpress.comStep 1: Open the PRC LERIS website at https://online.prc.gov.ph.Close all pop-ups. If you have an account with the old system at www.prc-online.com, take note that your account is no .

zero beta portfolio|beta neutral portfolio